In this article, we will discuss the different types of insurance coverage and what they cover. We will also discuss how to choose the right insurance coverage for your needs.

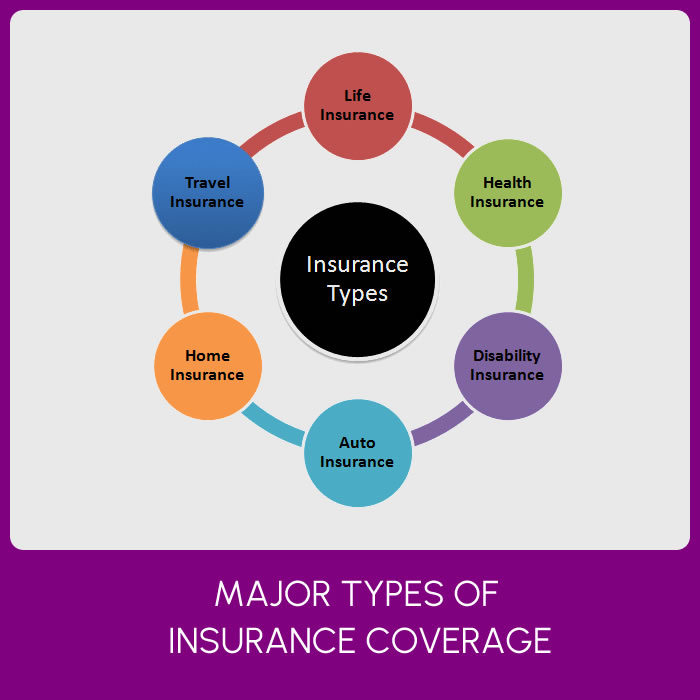

Different types of Insurance Coverage

However, while auto-insurance can help protect your car against damage when you hit a pothole, traffic jam or other accident, it’s not really appropriate for businesses or homes Insurance is an essential part of a business’s strategy to increase its exposure to risk.

The main four types of insurance you require for your financial security may already be known to you. However, there are many other different types of insurance coverage that you should have and which you shouldn’t have.

Let’s take a look at these different options so you can make the best decision for yourself.

Different types of Insurance Coverage you may know about

Here are some types of insurance that aren’t appropriate for everyone else but that are great for small business owners:

Auto Insurance

If you want to buy and operate an automobile, you must have auto insurance.

Homeowners or Renters Insurance

Homeowners or renters insurance can shield you against financial damages brought on by fire, theft, or other disasters.

Life insurance

Protect your family with life insurance so they won’t have to worry about finances while grieving if the worst happens.

Health Insurance

Health insurance to prevent financial ruin due to urgent medical expenses. Many people consider themselves to be healthy until they experience a health issue. Therefore, they should be covered under some type of health insurance. The most important thing to keep in mind is that you must have health insurance.

3 different types of Insurance Coverage You Need

We are here explaining about those 3 different types of insurance coverage you need to have. Read on below.

1Term Life Insurance Insurance Coverage you may need

Whole life insurance typically comes to mind when people think about life insurance. This policy requires long-term payments, and the benefit is maintained until your death.

Term life insurance functions more like a car insurance plan. You make a predetermined payment every year or month for the specified number of years. It pays out if you pass away while the policy remains in force. It doesn’t matter if you’re still alive at the end.

The drawback of term life insurance is that second aspect. Its significant cost savings over a whole life policy is an advantage. For each dollar spent, you can get a lot more insurance.

Anyone who wishes to safeguard their family during the years when income is most crucial—when your children are small and your mortgage and car payments are substantial—should consider purchasing term life insurance. To help with transition and bereavement management, a term life insurance policy can provide the equivalent of five to ten years of salary.

You can evaluate your family’s financial needs for the subsequent term once the initial term policy expires. You can cut back on or get rid of the coverage if your children are older, you have more money saved up, and your costs are lower. You can obtain more coverage for the upcoming few years if your prices remain the same or increase.

DOs for Term Life Insurance

| 1 | Check to check if your place of employment, labor union, trade association, or interest group has group term insurance. This may result in even lower insurance costs. |

| 2 | Do a provider search for insurance. Although term life insurance contracts aren’t usually sold in good faith, you may learn about any insurer’s reputation online. |

DON’Ts for Term Life Insurance

| 1 | Don’t lie about your occupation, career, or interests. The insurer may not mention it when you sign up and pay if you do this, but they will probably use it to refuse payment if your family later requires it. |

| 2 | Don’t purchase more or less insurance than you require. Determine how much your family would need, such as a few years of your wage or the mortgage’s payback value, and keep to that amount. |

2Long-Term Disability Insurance Coverage you may need

It can firstly keep you from working. In this regard, long-term disability insurance resembles life insurance greatly, and it is possible to purchase life insurance that also covers permanent disability.

Even if you are able to work, you may be forced into a different profession with a lower pay grade, which will reduce the amount of money you may make.

Second, the expense of medical care can be significant, particularly if your handicap necessitates long-term, permanent, or palliative care. A circumstance like that might deplete your finances faster than most people think.

Long-term disability insurance replaces your income from work while you are recovering by paying you a predetermined sum, typically a percentage of your average monthly income.

DOs for Long-Term Disability Insurance

| 1 | Do verify the start and finish dates of the term. Most insurance policies contain a time limit on how long they’ll pay out and a requirement that you wait until after your first missed payment before they start to pay out. |

| 2 | If you don’t have an emergency money, Do consider short-term disability. This takes care of the first lag period to close the gap. |

DON’Ts for Long-Term Disability Insurance

| 1 | Don’t forget to compile records throughout your initial therapy in order to expeditiously substantiate your case. |

| 2 | A policy without a “own occupation” clause is one you SHOULD NOT purchase. According to this rule, you are protected if an injury forces you to change jobs. Without it, an insurer might decline a surgeon’s claim on the grounds that he is unable to practice surgery but would be an excellent Walmart greeter. |

3Supplemental Health Insurance Coverage you may need

You receive a cash reimbursement from supplemental health insurance for every dollar you spend on medical coverage. For instance, if your office visit deductible is $100, you might get additional health insurance to cover at least $50 of that amount.

Supplemental health insurance plans may also include a disability benefit, providing a modest but occasionally important reimbursement for different injuries.

It could be a few hundred dollars for a broken bone, a few thousand dollars to recuperate from surgery, or even a year’s worth of wages for a lifelong disability, depending on the specifics of each insurance.

DOs for Supplemental Health Insurance

| 1 | Do perform the calculations. It is not worth purchasing if the premiums for this coverage are higher than what you pay out of pocket annually. |

| 2 | Discover a policy with flexible payment terms. This is covered by a lot of additional health insurance. It implies that you are exempt from paying premiums while you are unwell or wounded. |

DON’Ts for Supplemental Health Insurance

| 1 | Assume not that all policies are equivalent. Even more so than other types of insurance, these vary widely. Make comparisons side by side and do your research. |

| 2 | If you have coverage, don’t forget to file. Over time, even the smallest dividends might add up. |

Different types of Insurance Coverage You Don’t Need

Depending on your circumstances, you could require some of the others as well. For instance, when your standard homeowners policy doesn’t cover flood damage to your property, flood insurance will. most don’t.

Nevertheless, despite the best efforts of dishonest insurance sellers, there are a few different types of insurance coverage that virtually no one needs. These consist of:

Debt Insurance

Debt insurance, which can make payments for you if a calamity or loss of job prevents you from doing so on your credit cards, auto loan, or even mortgage. You would be better off investing that money in savings because it is too expensive compared to the danger.

Event Insurance

Event insurance pays you back if you have to postpone or cancel a wedding, bar mitzvah, vacation, or other such event. Instead, do your best to reduce costs and risks during the planning process.

Life insurance for children

Unless it guarantees insurability and your child is at risk of a hereditary disease that disqualifies them, life insurance for kids is not recommended. If not, your danger isn’t significant enough to warrant the expense.

Extended Warranty Insurance

After purchasing an expensive item, extended warranties give low-cost or free maintenance for an additional year or two. Unless you purchase a lemon, these nearly always end up costing more than the repairs or replacements. In that scenario, you also have additional forms of protection.

Final Thoughts

We have discussed about different types of insurance coverage here, we think thy might help you. Saving money in an interest-bearing account is frequently the best course of action for ensuring your financial security. You can then use the money to buy something else when you don’t need it and have it available when you do.